Morning’s 1% gain went into vain at the closing.

Table of Contents

Table of Contents

1. Indian Markets

2. Asian Markets

3. Sectoral Indices

4. Gainers & Losers

4.1 Nifty 50 Gainers

4.2 Nifty 50 Losers

4.3 Nifty 500 Gainers

4.4 Nifty 500 Losers

5. FII & DII Activity

6. Key Points

1.0 Indian Markets

Indian Market opened 1% upper after yesterday’s fall of 2.68%. The nifty 50 opened around yesterday’s day high. but all the gains lost throughout the day. in the end nifty closed at 23,992. dropped by almost 350 points from the day’s high.

|

| Nifty 50 chart today |

Today Nifty 50’s 21 stocks gained while 29 were in red after downtrend move today.

|

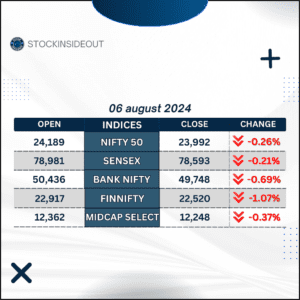

| Indian Market Indices as on 06 Aug 2024 |

Market in the morning opened in the green but after opening in green it is turned into red. Nifty 50 closed below 0.26%, Sensex below 0.21%, Midcap Nifty below 0.37% and financial indices, the Bank Nifty & Fin Nifty ended their day below 0.69% & 1.07% respectively.

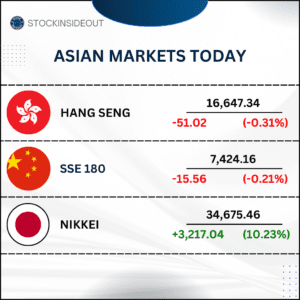

2.0 Asian Markets

Japan’s Nikkei Index finally turned into green color with more than 10% gains today and ended the red day streak. China’s & Hong Kong’s indices were down by small margin.

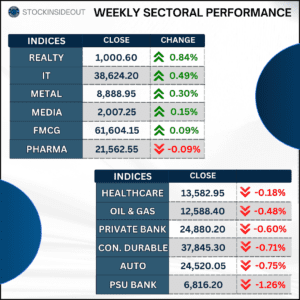

3.0 Sectoral Indices

Realty, IT, Metal, Media, FMCG were the sectors that remained in green on the red day.

Realty index was up by 0.84%, IT was up by 0.49%, Metal was up by 0.30%, Media was up by 0.15%, and FMCG was up by 0.09%.

The sectors that closed in red today are.. Pharma (down 0.09%), Healthcare (down 0.18%), Oil & Gas (down 0.48%), Private bank (down 0.60%), Consumer durables (down 0.71%), Auto (down 0.75) and the sector that lost most today is the PSU Bank which is down by 1.126%.

4.0 Gainers & Losers today

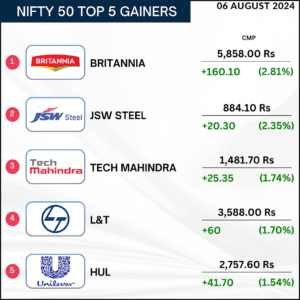

4.1 Nifty 50 Gainers

Nifty 50’s 21 stocks were in the green today. Here’s the list of top 5.

- Britannia gained by 2.81%

- JSW steel gained by 2.35%

- Tech Mahindra gained by 1.74%

- L&T gained by 1.70%

- HUL gained by 1.54%.

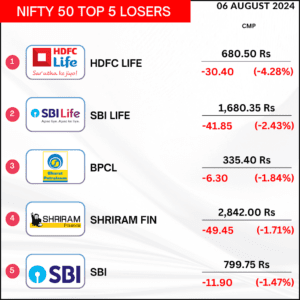

4.2 Nifty 50 Losers

HDFC Life, SBI Life, BPCL, Shriram Fin & SBI were the top 5 losers in today’s nifty 50 index.

HDFC Life is the biggest loser in today’s session (down by 4.28%), SBI Life is down by 2.43%, BPCL is down by 1.84%, Shriram Fin down 1.71% and SBI lost 1.47% today.

Nifty 500 Gainers & Losers.

4.3 Gainers

|

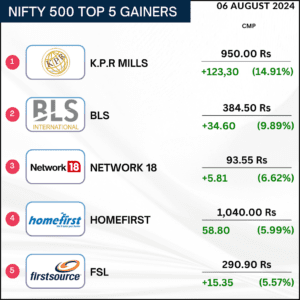

| Nifty 500’s Top Gainers today. |

K.P.R mills was the top gainer in today’s negative market. KPR mills surged around 15%. BLS Internationals was the next top gainer. gained around 10%. Network 18 gained 6.62%, Homefirst gained by almost 6%, FSL gained by 5.57%.

4.4 Losers

|

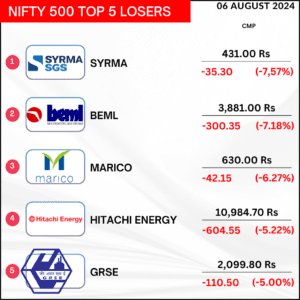

| Nifty 500’s Top Losers today. |

SYRMA SGS technology LTD was the biggest loser today. down by 7.57%. BEML was the next loser in today’s market (down by 7.18%). Marico was down by 6.27%. Hitachi Energy was down by 5.22%. GRSE was down by 5%.

5.0 FII & DII Activity

|

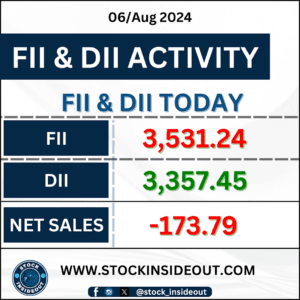

| FII & DII Activity today |

FII sold shares worth Rs. 3,531.24 crore. DII sold shares worth Rs. 3,357.45 crore. that makes the Net sales of Rs 173.79 crore for the day

6.0 Key Points of today’s recap

Take a look at key points of today’s recap.

- Mornings’s gain lost by the closing.

- Japan’s Nikkei up by 10%. Ending the red streak.

- Realty sector was the best performer, up by 0.84%.

- The worst performing sectoral index was the PSU Bank Index that is down by 1.36%.

- Britannia was the top most gainer after gaining more than 2.8% today.

- Worst nifty 50 performer was the one of the most favorite stock, the SBI that is plunged by 1.5%.

- K.P.R Mills was the top gainer of nifty 500 index and SYMRA was the top Loser.

- DII bought the shares worth 3,531.24 crores while FII sold shares worth 3,357.45 Crores. Total Net Sales 173.79 crore.

Note :- We are only Information providers. We do not recommend anyone to buy or sell stocks. We are not SEBI registered. Please Contact your Financial Advisor before Investing.