The BSE Sensex Index, featuring India’s top 30 companies, ranks among Asia’s leading indices. On 23 December 2024, Zomato, a food delivery company, will join this index, replacing JSW Steel.

Zomato has come a long way since 2008, from a startup to a respected SENSEX member. Its stock has risen 268% since IPO, showing strong investor trust. This growth story highlights Zomato’s strength and vision. Let’s look at the key moments in its financial journey.

Table of Contents

Journey from ‘Foodiebay’ to ‘Zomato’:

Starting as ‘Foodiebay’ in 2008, Zomato began its journey by offering restaurant information and menus on its website. In 2010, the name was changed to ‘Zomato’ as the founders, Deepinder Goyal and Pankaj Chaddah wanted the company to go beyond just the food business.

Early Days Funding

Seed funding supported the company during its early days. In 2010, ventures like Info Edge and Sequoia Capital invested, enabling Zomato to expand its operations.

Info Edge initially invested ₹4.7 crores in Zomato in 2010. Subsequently, in 2013, Zomato secured ₹227 crores through additional investments from Sequoia Capital and Info Edge. This funding significantly boosted the company’s valuation, pushing it to over $150 million.

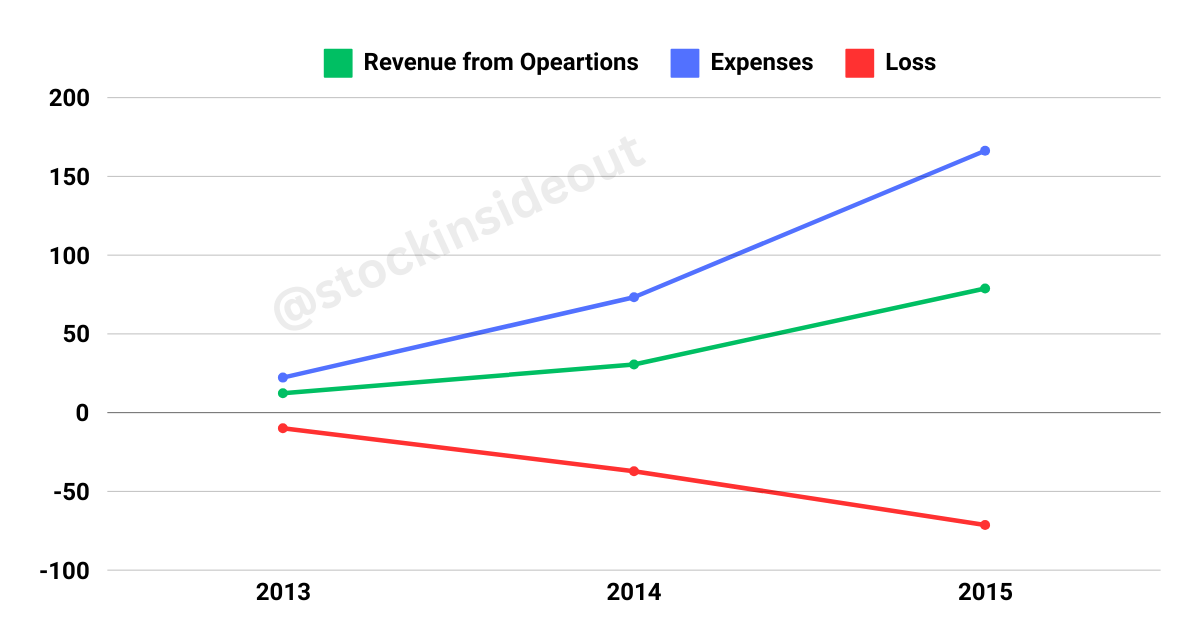

Early Struggles:

At the start, the company’s revenue relied heavily on restaurant listing and advertising, which were not enough to sustain the business. The company’s growing expenses had put the company in significant losses as they were more focused on expanding business and marketing.

In 2015, The company entered into the online food delivery sector and table reservations to generate more revenue sources, But this move also increased the cost of the company during the early stages of development

Zomato Businesses Expansions

Zomato has made several expansions and acquisitions over the years, but not all have stood the test of time. Here, we’ve highlighted some of the most significant and enduring ones, which continue to contribute to the company’s growth and success.

- In 2011, the company launched an online ticket-booking platform and rapidly expanded its operations across India and internationally.

- Zomato made significant changes to its strategy and ventured into the online food delivery business in 2015. The company expanded its focus from restaurant listings and information to offering food delivery services.

- In 2018, Zomato bought WOTU and renamed it ‘Hyperpure.’ This service helps restaurants get kitchen ingredients and products directly from Zomato’s warehouses, making the process easier and faster.

- In 2023, Zomato expanded further by buying Blinkit, a quick-commerce company, for $568 million. Blinkit delivers groceries and daily essentials to customers through its app.

Related: Zomato Fundamentals: Still Worth Buying?

Journey From Loss to Profit:

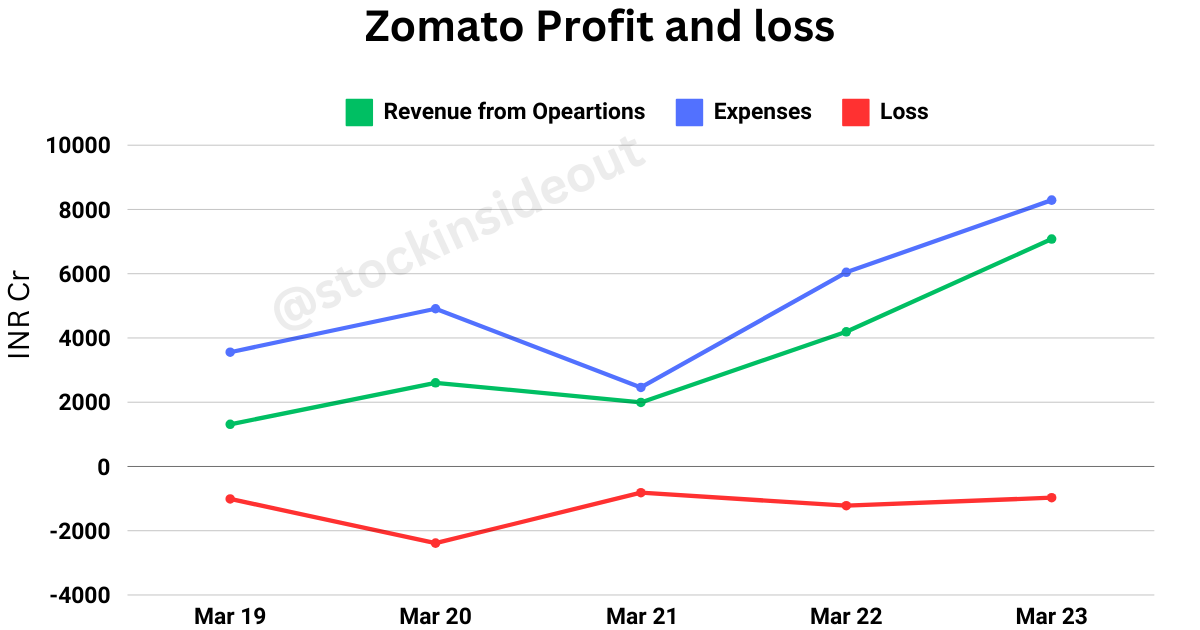

Profit and Loss of Zomato during 2019-23

However, Expanding the business has caused some losses for the company during the development stages.

But why? Let’s find out. Here is a graph of the Consolidated revenue, expenses, and profit incurred during the 2019-2023 period.

Revenue, Expenses, and Profit incurred between 2019-2023 of Zomato LTD. The company’s revenue has been rising over the years. However, its expenses have consistently exceeded its revenue, resulting in losses in the profit and loss statement for the food delivery segment.

Revenue, Expenses, and Profit incurred between 2019-2023 of Zomato LTD. The company’s revenue has been rising over the years. However, its expenses have consistently exceeded its revenue, resulting in losses in the profit and loss statement for the food delivery segment.

why are the expenses so high? Where is the company spending its capital? Let’s explore the reasons behind these higher expenses.

Expenses incurred of Zomato during 2021-2023

| Mar 21 | Mar 22 | Mar 23 | |

|---|---|---|---|

| Purchase of stock in trade | 203 | 552 | 1,438 |

| Changes in Inventory | -11 | -28 | -43 |

| Employee Benefit Expense | 741 | 1,633 | 1,465 |

| Finance Cost | 10.08 | 12.00 | 48.70 |

| Depreciation | 138 | 150 | 437 |

| Other Expenses | 1,528 | 3,885 | 5,429 |

| Total Expenses | 2,609 | 6,205 | 8,775 |

The table below suggests the expenses incurred by the company during the period of 2019-2023. The numbers shown in the table are in Cr Rs.

As shown in the table, Zomato’s “other expenses” account for over 55-60% of its total expenditures. These expenses primarily consist of advertising costs and outsourcing support costs, such as delivery and manpower-related charges.

These costs were a major contributor to the company’s losses until 2023. However, Zomato’s financials took a turn for the better in 2024. Let’s examine what drove this change and how the company achieved profitability.

The Turnaround: From Losses to Profits

After being in the losses for years, Zomato’s profit and loss statement finally turned into profits in 2024. Thus, Let us explore how the company performed and what helped to overcome the losses.

Cons. Profit and Loss March 2024

| Mar 23 | Mar 24 | |

|---|---|---|

| Revenue from Operations | 7,079 | 12,114 |

| Revenue Growth | – | 71.12% |

| Other Income | 682 | 847 |

| Total Income | 7761 | 12,961 |

| Expenses | ||

| Purchases of S-I-T | 1,438 | 2,887 |

| Changes in Inventories | -43 | -5 |

| Employee Benefit Exp | 1,465 | 1,659 |

| Finance Cost | 49 | 72 |

| Depreciation | 437 | 526 |

| Other Expenses | 4,529 | 7,531 |

| Total Expenses | 8,775 | 12,670 |

| Expenses Growth | 44.48% | |

| Profit Before Exceptional Items and Tax | -1,014 | 291 |

| Exceptional Items | 0.10 | – |

| Profit Before tax | -1,014 | 291 |

| Total Tax | -44 | -60 |

| Profit/Loss of the year | -971 | 351 |

The years of expansion and strategic marketing helped the food delivery company to post their highest-ever profit on their profit and loss statement for the first time. As we can see from the table above, Zomato posted its highest-ever profit of Rs 291 Crores in FY 24, a significant turnaround from a loss of Rs 1,014 Crores last year. The company’s EBITDA also turns positive for the first time to Rs 42 Crores in FY 24.

Related: Understand the Meaning, Types, and Formula of Revenue from Operations.

This turnaround was driven by a 71% growth in Revenue from Operations, with expenses increasing by only 44%. Improved resource utilization and efficient scaling enabled the company to overcome its losses and achieve sustainable profitability.

Growth Journey Continues in FY 25.

Zomato remains the most favored food delivery company, with growing demand driving revenue and profit increases in FY 25. Let’s review its recent quarterly performance.

| Q1 FY25 | Q2 FY25 | |

|---|---|---|

| Revenue from Operations | 4,206 | 4,799 |

| Operating Expenses | 177 | 226 |

| Net Profit | 253 | 176 |

Zomato has consistently delivered exceptional services to its customers and strong quarterly results to its investors. The company’s net profit has grown significantly, marking a 200-times increase in the first quarter of FY25 compared to same period last year.

This impressive performance continued in the most recent quarter as well. Zomato reported a net profit of ₹176 crores, a substantial jump from ₹36 crores in the corresponding quarter of the previous year.

With such consistent growth, Zomato has shown it can do well both in its business and finances. This success has earned it a place in India’s famous Sensex index, benefiting its customers and investors.

The Stock Journey:

The Successful IPO Launch

Zomato’s IPO was launched on 14 July 2021 and listed on 23 July 2021 at a price of ₹115, which was a 51% gain over the issue price of ₹76. This successful listing marked a major milestone for the company, offering strong Zomato IPO listing gains to investors right from day one. With overwhelming demand, the Zomato IPO was oversubscribed by 38.25 times, showcasing the market’s confidence in the company.

The Remarkable Stock Journey

Zomato has delivered impressive returns since its IPO, with a remarkable since IPO return of 268%. Over the past year, the stock has continued its strong performance, posting a 1-year return of 146%. As of now, Zomato’s current market cap stands at ₹247,205.51 crores, reflecting its strong position in the market.

Ready to Enter The Sensex

Remarkable growth driven by its strong position in the food delivery sector and consistent financial performance, played a key role in Zomato’s inclusion in the prestigious BSE Sensex index on 23 December 2024, replacing JSW Steel.

Zomato’s market strength, coupled with its ability to capitalize on the growing demand for food delivery services, underscores its leadership in the sector. As a result, Zomato’s inclusion in the SENSEX index is a significant milestone, marking its entry into the elite group of India’s top 30 companies. This achievement is expected to further boost investor confidence, highlighting Company’s continued growth and stability.

Conclusion:

Zomato’s inclusion in the BSE Sensex marks a historic milestone in its journey from a startup to a market leader. Its turnaround from losses to profits, driven by strategic growth and operational efficiency, showcases its resilience and vision. With consistent financial performance and strong investor confidence, Zomato is poised to sustain its leadership in India’s food delivery sector. This achievement cements its place among the nation’s top 30 companies, paving the way for continued success.

Know someone who’d find this useful? Share it with them!

Join us on our Social Platforms.