Using AIs for Financial use can be very Easy and Cost Effective but Do you know its risks and benefits? Let us Learn the Benefits and Risks of AI-driven Financial Insight in this article.

Key Takeaways

- AI is fast, cost-effective tool

- AI can give every type of financial information and suggestion<

- The risk that comes with AI-driven Financial Insight is that the advice and insight provided may not be up to date.

- AI programs are useful when an individual can balance it with human expertise

1. Introduction:

As we all know, the world is rapidly developing unimaginable computer programs. Today we will be talking about the recently built AI programs, We have seen AI is used for almost everything in today’s world. it is found to be helpful in many cases, Users find it easy to use and fast to answer the questions.

AI has also become an easy source for financial questions and advice, from investing strategies to budgeting personal finance. Individuals and Business owners have started to use AI programs. But is it safe and beneficial for financial information? Can you depend on the financial information that AIs provide? Well, Today let us learn its risks and benefits along with real-world examples.

2. Benefits of AI in finance:

AI programs are made to be Time efficient. These programs are likely to be a friend who goes through all types of data available on the internet to answer your questions in no time. AI programs are made to be user-friendly and it has several types of benefits. But in this article, we will be learning about the use benefits of AI in finance, Which are as follows:

2.1 Real-Time Data Analysis:

A benefit of AI in finance is that AI programs can process and analyze all types of financial data in real-time. AI is likely to provide insights humans may miss. AI can provide everything that a trader or investor needs in real time, which is likely to be useful in decision-making for stock trading, market analysis, and identifying investment opportunities.

2.2 Personal Financing Advisor:

AI can be beneficial for your financial advice, which can give you suggestions and recommendations for your budget. AI can advise any individual based on his/her financial situations, goals, and risk tolerances after analyzing one’s money earning, and spending habits, and investing habits. AI can advise on investment plans, budgeting tips, and saving plans.

2.3 Money Saver:

A Financial Advisor charges a huge amount of money for their services. On the other hand, AI programs are cost-effective solutions for every type of user or audience. It can give valuable information to finance experts as well as finance learners either free of cost or at a low price compared to financial advisors.

2.4 Useful in Market Analysis:

Humans are likely to take time to analyze any market such as chart patterns and financial trends compared to AIs. The AI algorithm is time efficient and likely to detect chart patterns and forecast financial trends faster than humans and provide useful insight which is difficult to do manually.

2.5 Access anytime and anywhere:

AI is accessible to use 24 hours and at any place if one has the internet. AI is a very beneficial program that can answer to the questions you ask or give you financial advice and insight anytime and anywhere.

3. Risks and Limitations of using AI in finance:

It is said that “If there are benefits, There is always a risk”. Similarly, It is no different in the case of using AI for financial benefits. Hence, We have found a few risks and limitations that are associated with AI-driven Financial Insights.

3.1. Financial Data Inaccuracy:

AI can be useful for finding solutions and insights regarding your financial questions. However, AI only provides financial data that is already available on the internet. AI heavily relies on data that is available on top websites and other government-related websites. Hence, There is a chance of inaccuracy of AI-driven financial insights

3.2 Data Privacy:

To provide suggestions and recommendations, AI needs access to sensitive financial information and key insights. Hence, It raises concerns over data privacy and financial security, if any breach occurs then it may be exposure of personal financial data to an unauthorized party.

3.3 No human judgement:

AI is a program that is solely based on algorithms, It has no human emotions. Most of the time financial decisions need human judgment because financing topics are related to mostly emotional touches. AI programs can only provide judgments based on the algorithm, AI-driven financial insight may miss out on current financial circumstances, market insights, and emotional factors to make decisions.

4. Example of Benefits and Risks:

In, this topic we will be learning how AI can benefit you and the Risk that comes with it. We will be using “Chatgpt” as a platform to understand our example.

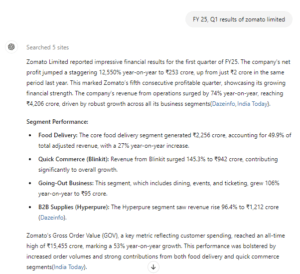

|

| Source:- Chatgpt |

Benefit:

In the picture above, We have asked “Chatgpt” to give an insight into The Q1 FY 25 results of Zomato Limited and it has provided detailed information from 5 websites in less than a minute. If we were to search the results of Zomato company, then it would have taken us at least 10 minutes to search into the insight of the company’s results but the AI gave in less than a minute and free of cost.

Risk:

As we have seen in the picture above, The AI program has searched 5 websites to give insight. It heavily relies on the data that is posted by other websites. The insights provided by the AI may only be accurate if the data is correctly posted on third-party websites.

5. How should AI be used for financial concerns?

AI technology is widely used all over the world and it is currently the best technology that is built. However, its benefits depend on the users who use it properly. So, Let us learn how AI should be used for financial insights.

5.1 Use AI for Information and not for recommendation:

AI is the best place to get information regarding every type of financial data. The AI can provide useful data to make decisions regarding investing and trading. AI’s data is not based on human emotions. It lacks human expertise and experience. Use AI only to gather data and always consult your financial advisor before making decisions.

5.2 Prioritize data safety:

While using AI, One should use AI that is safe, secure, and well-known. AI can be hurtful if its owner uses your data for self-use. Users should not provide personal data to AIs. Keeping personal financial data should be the priority.

5.3 Do not rely on AI-driven financial insight:<

Financial insights driven by AI may not be 100% accurate. Data provided by AI may not be up to date. AI tools need continuous updates and monitoring to keep up with today’s fast-moving world. It is always best to recheck that the AI-drive financial insight is correct with the latest financial data and regulatory changes.

6. Conclusion:

AI is considered to be the best invention of the current world. It is just like a friend whom you can ask anything and get answers to almost everything. It is a cost-effective tool that offers so many benefits and personalized advice. However, data privacy should be a concern and it is important to understand the risks that come with AI-driven insights. AI programs are algorithm-based and it can not provide advice based on human emotions and needs. AI can be helpful and safe to use in the finance sector, If users can balance AI-driven financial insights and human expertise.

Know someone who’d find this useful? Share it with them!

Join us on our Social Platforms.